Behavioral Equilibria

Essential Questions

- What is quantal response equilibrium and how does it model noisy best responses?

- How do fairness considerations alter equilibrium predictions?

- When should analysts move beyond Nash equilibrium to explain data?

Overview

Traditional game theory assumes perfect best responses. Yet empirical data show players make occasional mistakes and care about fairness. Behavioral equilibria incorporate stochastic choice and social preferences to better match observations.

This lesson introduces quantal response equilibrium (QRE), explores fairness equilibria, and applies them to auctions and public goods games.

Quantal Response Equilibrium

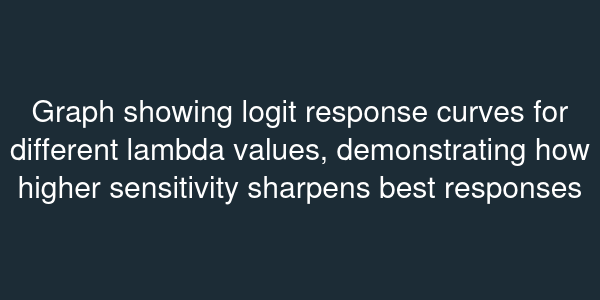

QRE assumes players choose actions with probabilities increasing in expected payoff but allowing for errors. The logit QRE specifies that player selects action with probability where measures sensitivity to payoffs. As , QRE converges to Nash; as , choices become random. QRE solves for a fixed point where strategies produce the expected payoffs used in the logit formula.

Fairness Equilibria

Fairness equilibrium concepts incorporate social preferences directly. Rabin's fairness equilibrium states that each player's strategy is a best response to beliefs about others' kindness. The equilibrium condition requires mutual best responses in terms of both material payoffs and fairness adjustments. For example, in the gift-exchange game, workers respond to high wages with high effort because they perceive the employer as kind. Employers anticipate this and pay more than the minimum.

Applications

In auctions, QRE predicts overbidding in first-price auctions when is finite, aligning with lab data. In public goods games, adding fairness concerns increases contributions: players derive utility from matching others' contributions, creating a fairness equilibrium that sustains cooperation even when Nash predicts free-riding.

Policy analysts use QRE to evaluate the robustness of mechanisms to bounded rationality. For example, when designing emissions trading, regulators simulate QRE to understand how firms with noisy responses might bid for permits. Fairness equilibria guide wage-setting policies that rely on intrinsic motivation.

When Nash Fails

Nash equilibrium remains a cornerstone, but when data show persistent deviations—like altruistic punishment or stochastic choice—behavioral equilibria provide better predictions. Estimating from experimental data allows you to quantify the noisiness of decisions. Combining QRE with social preference parameters yields models that inform contract design, auctions, and policy interventions more accurately.