The Rational Agent in Markets

Essential Questions

- How does individual rationality scale into competitive market outcomes?

- What conditions guarantee market efficiency under classical assumptions?

- Why do behavioral deviations matter for equilibrium predictions?

Overview

You are tasked with briefing a venture fund on whether crypto markets can remain efficient when retail investors flood in. Traditional finance insists that prices reflect all available information: if arbitrageurs act rationally, mispricing disappears. But behavioral anomalies—overtrading, rumor-driven bubbles—cast doubt. Before we dive into biases, we need the clean baseline: how rational agents generate efficient markets.

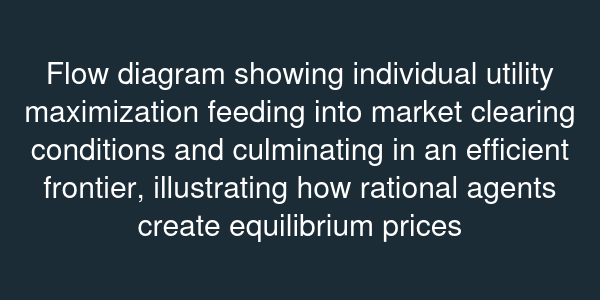

This lesson traces the path from individual optimization to equilibrium. You will examine the First Fundamental Theorem of Welfare Economics, consider the Efficient Market Hypothesis, and start mapping the cracks where psychology seeps in.

From Optimization to Equilibrium

Consider an economy with consumers maximizing subject to budget constraints . Under rational choice assumptions, each consumer chooses . Markets clear when , the aggregate endowment. The First Fundamental Theorem states that any competitive equilibrium allocation is Pareto efficient provided preferences are locally non-satiated. The proof hinges on supporting hyperplanes: if an allocation were not efficient, there would exist another feasible allocation making someone better off without hurting others, contradicting optimality of the price-taking choice.

In finance, the Efficient Market Hypothesis (EMH) operationalizes this. If each investor maximizes expected utility and information is symmetrically available, prices follow a martingale: . Any predictable pattern would be arbitraged away because agents with rational expectations would exploit it.

Stress Tests from Behavior

Empirical anomalies pressure the EMH. Robert Shiller documented excess volatility: stock prices fluctuate more than can be justified by changes in dividends when discounting under rational expectations. Bubbles like the Dutch tulip craze or the dot-com boom reveal persistent mispricing even when arbitrage is possible. Laboratory experiments replicate bubbles using rationally modeled traders, suggesting something beyond information asymmetry.

Behavioral finance introduces limits to arbitrage and psychological biases. Noise traders may be risk-loving, and arbitrageurs face capital constraints, preventing them from correcting mispricing instantly. Investors anchor on past prices, chase momentum, or exhibit disposition effects—selling winners too early and holding losers too long. These behaviors violate the rational expectations assumption required for the EMH.

Preparing for Behavioral Markets

Understanding the rational benchmark equips you to spot where it fails. When you analyze a policy like a carbon tax, classical theory predicts firms equate marginal abatement costs to the tax. Behavioral evidence may show procrastination or fairness concerns blocking adoption. In the next unit you will quantify biases like loss aversion and probability weighting that systematically bend market outcomes away from the efficient frontier. Knowing the baseline allows you to measure the distance between invisible hand and invisible bias.