Prospect Theory Part I: The Value Function

Essential Questions

- How does reference dependence alter the evaluation of outcomes?

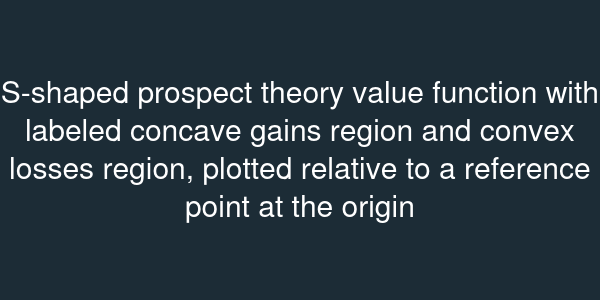

- Why does the S-shaped value function capture risk-seeking in losses and risk-aversion in gains?

- How can you estimate the curvature parameters from experimental data?

Overview

Imagine an airline experimenting with dynamic pricing. Customers anchor on the price they saw yesterday. Increase the fare slightly and complaints pour in; drop it below the reference and bookings spike. Prospect theory explains this asymmetry through a value function centered on a reference price, not absolute wealth.

In this lesson, you will examine the S-shaped value function, practice calculating subjective values of lotteries, and explore how to estimate parameters using regression on experimental choices. You will also connect the function's shape to real-world behaviors like gambling losses and risk-taking after setbacks.

Anatomy of the S-Shape

The prospect theory value function is concave for gains and convex for losses. Mathematically, for , (risk aversion); for , (risk seeking). Consider The exponent captures diminishing sensitivity: the difference between and feels larger than between and .

Suppose the reference point is dollars. Option A yields with certainty; Option B offers with probability and with probability . Subjective value of A: . Option B: . Despite a higher expected payoff, Option B feels worse.

Estimating Parameters

Researchers estimate and by fitting choice data. One approach uses maximum likelihood: assume individuals choose the option with higher subjective value plus a logistic error term, . Observing choice frequencies across varied gambles lets you estimate and along with sensitivity parameter . Field data, such as pay-as-you-go energy plans, provide natural experiments: consumption spikes when price dips below a reference contract, revealing the local curvature.

Real-World Dynamics

The S-shaped curve explains why casino losses can trigger risk-seeking. Falling below the night's reference bankroll pushes the gambler into the convex region, where the marginal value of big wins outweighs the pain of further losses. In corporate strategy, firms just shy of annual targets often take aggressive bets in Q4, mirroring laboratory evidence. In labor, unemployed workers accepting jobs below previous wages feel the wage cut more acutely, influencing reservation wages.

By understanding the value function, you can calibrate models that incorporate reference points, guiding pricing strategies, bonus structures, and policy framing.