Prospect Theory Part II: Probability Weighting

Essential Questions

- What mathematical forms capture probability weighting?

- How do overweighted small probabilities and underweighted large probabilities shape behavior?

- How does probability weighting interact with policy tools like lotteries or fines?

Overview

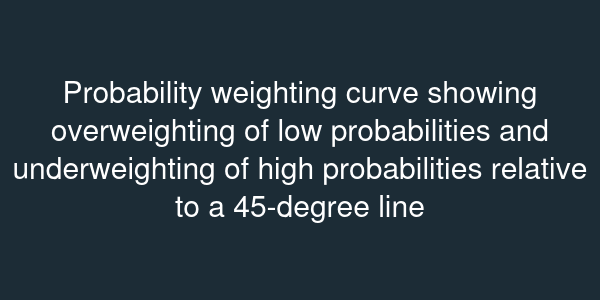

State lotteries fund public education because people overpay for tiny chances to win. The expected value is negative, yet tickets sell out. Conversely, households underinsure against common risks like floods. Probability weighting captures this pattern: we overweight small probabilities and underweight near certainties.

In this lesson, you will explore weighting functions, compute decision weights for real gambles, and evaluate policy designs that harness probability distortions. You will connect the math to applications from insurance markets to climate risk communication.

Weighting Functions

Cumulative prospect theory defines a weighting function that transforms objective probabilities into decision weights. A common specification is the Prelec function with . When , (overweighting), while (underweighting). The decision weight for outcome in a gain domain becomes , integrating the cumulative distribution.

Consider a disaster insurance policy: pay to avoid a loss with probability . Expected value of insurance is vs. expected loss of . If an individual underweights to , the perceived expected loss is , making insurance unattractive. Conversely, in a lottery with chance of winning million, might be , giving a subjective expected value of even though the ticket costs .

Empirical Evidence

Laboratory experiments ask participants to choose between certain amounts and lotteries with small or large probabilities. The classic study by Tversky and Kahneman found consistent overweighting of and underweighting of . Field evidence arises in microinsurance adoption: Karlan et al. observed low take-up rates even when actuarially fair, consistent with underweighting high-probability rainfall risk. In finance, investors pay premiums for out-of-the-money options, effectively overvaluing small-probability windfalls.

Policy Applications

Governments design "sin taxes" with probability weighting in mind. Rather than imposing certain small fines, they use lotteries. For example, Philadelphia's traffic safety lottery enters compliant drivers into a prize drawing; the overweighted small chance of winning boosts seatbelt use. Similarly, water conservation programs use prize-linked savings accounts: households who reduce consumption receive entries into a lottery, leveraging overweighted small probabilities to encourage pro-social behavior.

Probability weighting also informs climate communication. Catastrophic floods may have a annual probability. Communicating them as "a one-in-fifty chance" triggers overweighting more than stating "2%". By understanding how reshapes risk perception, you can craft interventions that align behavior with long-run welfare.